Top Money Management Strategies For Your Financial Freedom

Consumers are currently experiencing higher prices on various services and goods in many countries today. Inflation continues to rise with prices of rent, gasoline, and food becoming higher and higher. Many households are altering their investment strategy by allocating capital to hard currencies like bitcoin and gold or to real assets like apartment buildings.

Apart from these investment strategies, what options do you have as a consumer to seek financial freedom and security for your family? Here are some solutions.

Financial Freedom Definition

Personal finance covers everything regarding money management including saving and investing. It comprises banking, budgeting, mortgages, insurance, retirement planning, investments, as well as tax and estate planning.

Personal finance is about reaching your personal financial goals whether it’s planning for your comfortable retirement, saving for your kid’s education, or repaying your mortgage.

What is financial freedom? This term means having enough funds to cover your short- and long-term financial targets. Every family strives for financial security without getting into debt.

Having a strict plan and following freedom road financial advice can help you achieve this stability and security to fulfill your monetary needs. Being financially literate may help you make the most of your savings and income so that even a 3000 loan bad credit will be easily repaid if you urgently need extra funds.

9 Steps to Financial Freedom

1. Purchase Rather Than Rent

When inflation goes up, it’s more affordable to buy a house instead of renting it. Landlords often increase the rent at the level of inflation each year. When the inflation rate is low it may be quite reasonable to rent your home.

However, if the inflation rate is high the housing expenses will also increase and become less suitable for consumers. Mortgage rates are usually fixed and the value of your house will most likely increase with inflation so this strategy may protect your freedom financial network in the long run.

2. Make a Budget

Having a budget is essential for every household. Families should understand the importance of creating a budget to track their expenses and live within their means. This way, you will have enough left for your savings and long-term monetary goals.

The 50/30/20 budgeting rule is beneficial as it allows you to allocate fifty percent of your income toward living essentials (rent, groceries, utilities, transport), thirty percent goes toward discretionary costs (clothing, eating out), while the rest twenty percent is allocated toward the future (retirement, emergency fund, debt repayment).

3. Prevent Debt

If you want to reach financial freedom, debt relief should be your top priority. After all, you can’t feel financially secure if you have a mountain of debt to pay off. A simple rule not to spend more than you earn may help you avoid debt. It doesn’t mean you can prevent all kinds of debt such as a mortgage or personal loans. Sometimes it may be useful to request a lending solution to cover your money needs but you always need to return it on time.

4. Make an Emergency Fund

You should allocate some portion of your monthly earnings towards establishing an emergency fund. This fund will help you have some cash set aside for the rainy day so that it will be possible to avoid debt and use your own money. Unforeseen expenses may easily unsettle families and low-income households. If you want to prevent suffering, make sure to create an emergency fund at put away 20% of each salary there.

5. Get a Car Loan

Nowadays, the interest rates on car loans are rather low. Just as we’ve talked about the reasons to purchase your own home instead of renting, buying a car with an auto loan also makes sense when the inflation is high. Search around for fixed rates on auto loans. If you are a responsible borrower and find an interest rate below 3%, it will be affordable and rather cheap to purchase a new car.

6. Utilize Credit Cards Wisely

Do you want to avoid the debt trap? Then use your credit cards wisely while it’s almost impossible to live without any credit cards in the modern world. Having at least one or several credit cards may not only help you find better deals and save on various spending categories but also establish a good credit rating provided that you use your card wisely and pay the monthly balance.

7. Check Your Credit Score

Make sure you request your annual free credit report from one of the credit reporting agencies to monitor your credit rating and check the report for any errors. Maintaining a decent credit rating will help you qualify for more affordable rates on lending solutions and financial loans.

8. Think About Your Family

If you want to ensure your wishes are followed after your death and your assets are protected, make a will and possibly set up at least one trust. Think about life, home, car, and long-term insurance. Consider protecting your family members and review your insurance policy from time to time.

9. Save for Your Retirement

It may seem that you will have enough time to think about your retirement, but it’s better to start saving sooner than later. You will need around 80% of your present income in retirement so it’s worth thinking about these savings now.

What Personal Qualities Are Helpful for Money Management?

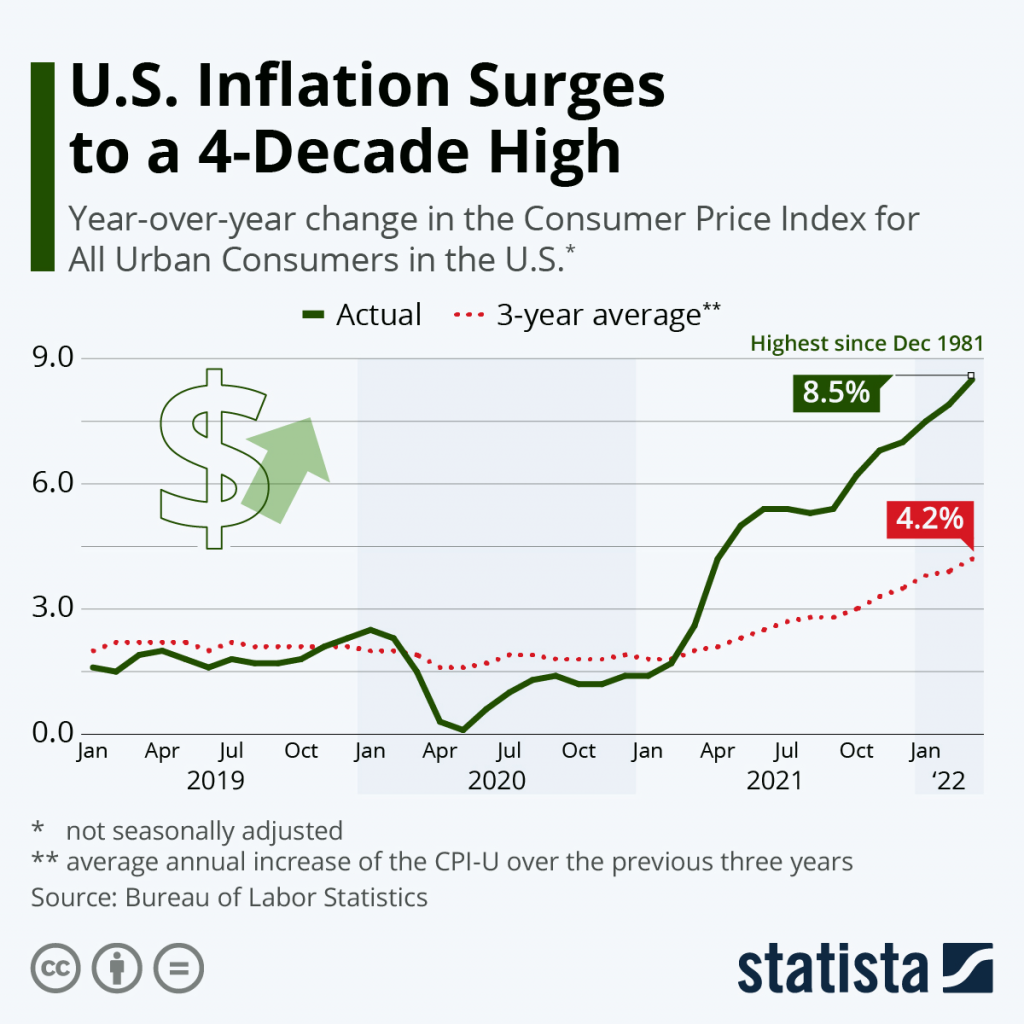

Consumer prices in the USA kept on rising in February and March 2022 after inflation had hit a 40-year high in January. The Consumer Price Index for All Urban Consumers was up 8.5 percent compared to a year ago, according to Statista.

If a person wants to get out of debt, save cash for retirement, and avoid overspending, he or she needs to be self-organized and determined. It takes a lot of effort and discipline to take care of your personal finances especially if you desire to achieve your financial goals.

You need to be concentrated on improving your financial stability and learn financial asset management so that it’s easier for you to cope with short-term money difficulties or disruptions that happen on your way toward financial stability.

In conclusion, these are the top tips for your family’s financial freedom to help you feel more financially secure.